Foal Insurance – Cover Available

The following cover can be purchased under both a KBIS Leisure Policy and KBIS Competition Policy.

Please note the information below outlines the cover available, if you have a policy with KBIS your exact cover will be specified on your certificate of insurance.

Death, Theft and Straying

Death,Theft and Straying is the starting point of your insurance. It is the benefit paid following the death or euthanasia of the horse or if the horse is lost or stolen and not found. This benefit will be the sum insured/market value of the insured horse

Vet Fee Cover

Vet fee cover provides the insured horse with cover for non routine veterinary procedures. Vet fee cover can be extremely beneficial and will help you to make sure your horse receives the veterinary attention required in the event of an injury without you, the horse owner, having to worry about the cost.

We offer a range of different vet fee cover options for you to choose from, depending on your horses age and the activities you are participating in.

Our Competition cover provides more comprehensive cover with incident limits up to £6,000, and cover for complementary treatment and hospitalisation. You can view the vet fee cover available under each policy below:

Competition Vet Fee Cover

Leisure Vet Fee Cover

Permanent Loss of Use

Permanent Loss of Use cover is available from when the horse turns 3 years old and is broken and ridden away. This horse must be working/competition at their chosen activity.

Public Liability

Public Liability is one of the most important areas to consider taking out cover. It provides the policy owner with cover against their liability to a third party, for example, if you were out hacking and your horse spooked and kicked a car causing an accident on the road. You can choose between three levels of cover, up to £1,000,000, £2,000,000, or £3,000,000.

Personal Accident

Personal Accident insurance covers you if you sustain a bodily injury through riding, handling, mounting or dismounting the insured horse. We can offer two levels of cover to choose from: Scale 1, which offers a benefit of £10,000; and Scale 2, which offers a benefit of £20,000.

Saddlery and Tack

We can provide cover for the physical loss or damage and theft of your tack in respect of the actual value at the time of loss but not exceeding the sum insured. Cover can be included for sums insured up to and including £10,000, with the excess £100 for each and every loss

Trailer/Horse Drawn Vehicle

You can insure your trailer (up to a value of £10,000) against physical loss or damage whilst immobilised and whilst being towed. The excess on this section is £100.

We can also provide stand alone trailer insurance for values up to £20,000

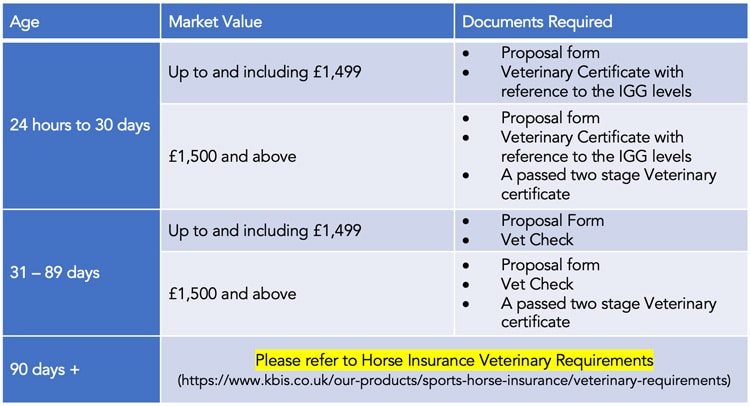

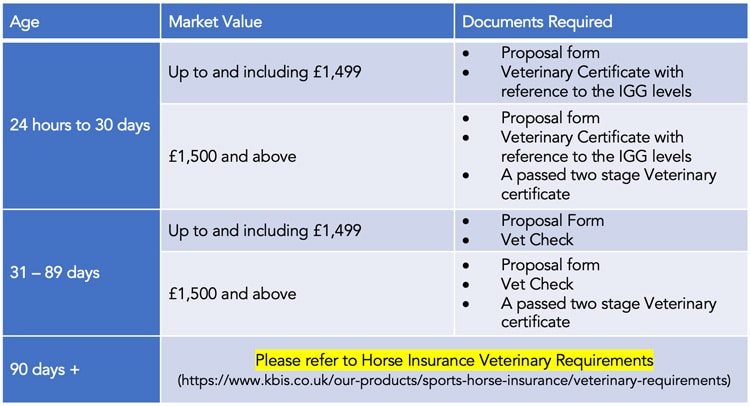

Foal Insurance – Vetting Requirements

The table below outlines our vetting requirements depending on the type of cover you wish to take out and the market value of your horse (not the value that you are choosing to insure the horse for).

For all levels of cover you will be required to complete a proposal form.

Foal Insurance – Loan Horses

If you are insuring a loan horse you will need to provide KBIS with a copy of the loan agreement. This means that KBIS can direct any claim settlements to the right party (veterinary fee claims are usually settled to the loanee whilst mortality and loss of use claims payments are settled to the owner).

In addition, KBIS will require a clinical print out from the veterinary practice showing the horse’s medical history.